August 27, 2020

We are now 5 months into the Covid-19 pandemic. “What is the impact on the load?” The load is changing due to the various shelter-in-place orders, many layoffs, and many of us working from home.

How do we determine the impact on the load?

We developed a method to determine the impact on the load. This method has been adopted at LDCs and was presented at the SGA Natural Gas Connect in July by an LDC.

We build models for each operating area with data through the end of February 2020. These models do not have the previous load as inputs; thus the models know nothing about the change in the load. The models do use weather, day-of-week, and day-of-year signals as inputs. The thought here is the models estimate the load had the pandemic not occurred. We forecast the non-pandemic load starting in March using observed weather. The variation of the actual load from the non-pandemic load tells us what impact the pandemic has had.

Here is a typical response

The data shown below is fictitious. It is being used to describe our analysis and what we see in a load response. We have analyzed more than 100 different customer bases. This analysis presented in this post is using 80 distinct customer bases from around the country. We selected these 80 as we have data through at least June 30, 2020.

Time Series Plots

The top chart is the daily average temperature (wind adjusted of course).

The second chart shows the non-COVID-19 expected load in blue, the actual load in red, the residual (residual = observed load – non-pandemic load) in gold. Thus, negative values here represent a load reduction.

The third chart shows just a zoom in on residuals (residual = load – non-pandemic load) in gold and the smoothed residuals in purple. Negative numbers are a reduction in the load. We have smoothed these since there is a lot of day-to-day variation and no modeling is perfect.

The bottom chart shows the percent residuals (100*residuals/actual) in gold and the smoothed percent residuals in purple.

This customer base starts seeing a reduction from expected in the second week of March. The reduction bottoms out down about 8% from late March to mid-April. Late April to early May it bumps up to down 5% but then has been in the range of down 7% to down 11% since. There is not much load in the summer months, so we do not want to make too strong of a conclusion based on this load.

Scatter Plot

This next chart shows the scatter plot of the load response.

This chart is color-coded by month. The expected (modeled) load, which was the blue trace in the second time series chart, are the dots (·) in this chart. The actual load is the open circles (o) in this chart. The dashed lines are the monthly trend line through the expected load. The solid lines are the monthly trend lines through the actual load.

We are only building monthly trend line models through a month of points, but we see in April that the actual (solid blue) trend line is below the expected (dashed blue) trend line. The table contains the change in the baseload, the change in the use per HDDW, and the change in the use per CDD we are seeing by month. In April the baseload is down about 10.5 MDth from expected and the heat load (below 55°F) is down about 380 Dth/HDDW from expected.

What are we seeing across various customer bases?

Here are the percent residuals for 80 customer bases from several LDCs from around the United States. Some are large, some are small. Some customer bases represent a system or core customers only, some include the transports, some just transports. The heavy blue line is the daily mean (weighted by annual volume of the customer bases). The annual use of these 80 customer bases accounts for 10.6% of the U.S. residential, commercial, and industrial use. The mean load reduction bottomed out in May at about 9% and has been between down 6% to down 8% since. As I said above, there is not much load in the summer months, so we do not want to make too strong of a conclusion based on this load in the summer.

This figure shows the distribution of the load change. 10% of the LDC customer bases by volume are down 15%. Where 25% of the LDC customer bases by volume have fully recovered or are even above non-pandemic projections.

We do not want to draw too many conclusions on what has happened to the load recently since these are summer months when the load is low. As we go into and through the heating season, we will be reviewing these regularly. GasDay models do have two mechanisms that help them track changing loads, either load destruction or load recovery or even load growth.

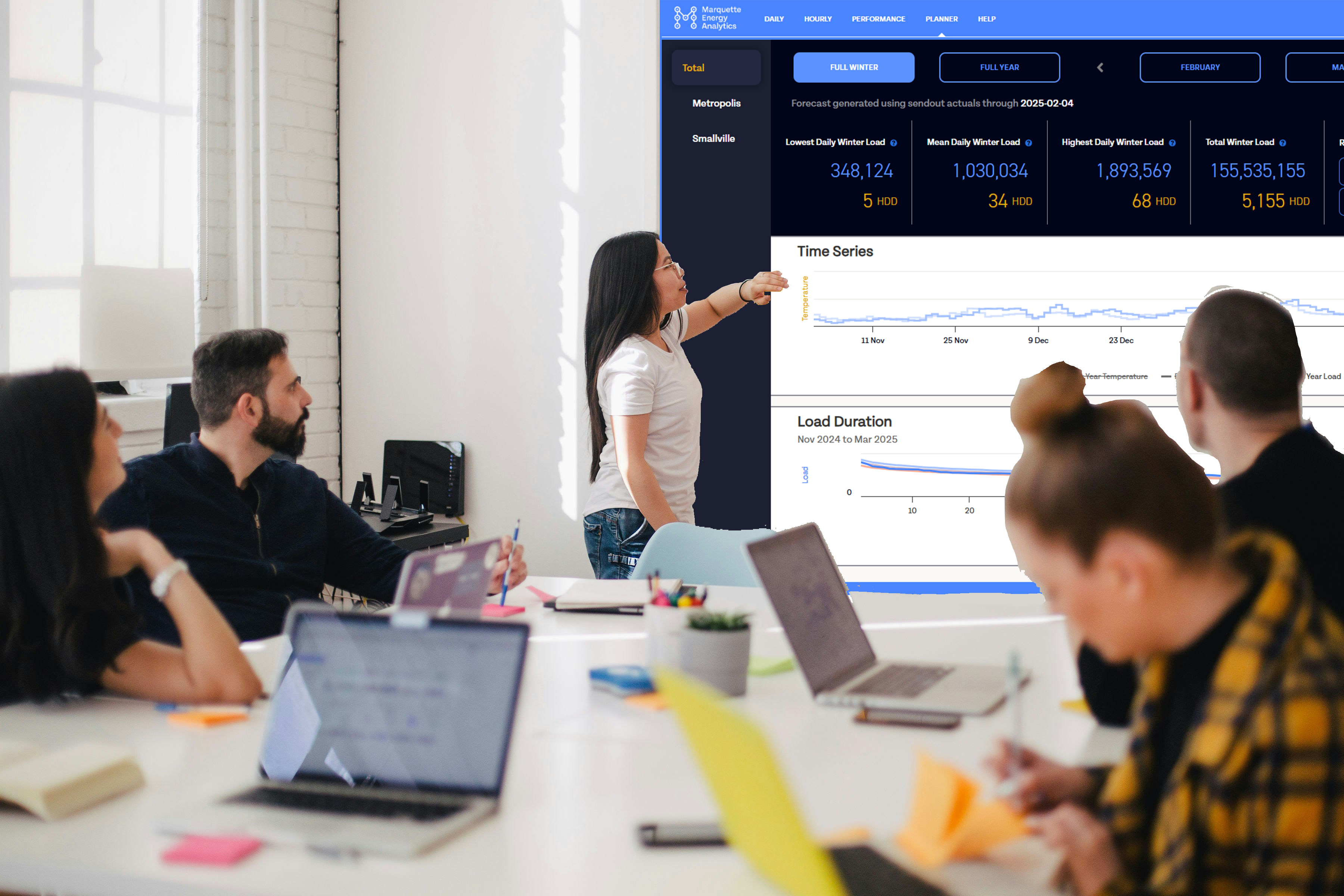

An offer to existing GasDay users: We can generate charts like the above in your operating areas. Those using our Web-based products just need to let us know. Those still on GasDay “Classic” (Excel interface) will need to send us their GasDay database.

Readers who are not users of our products are welcome to contact us to learn more about how Marquette Energy Analytics might be of help.